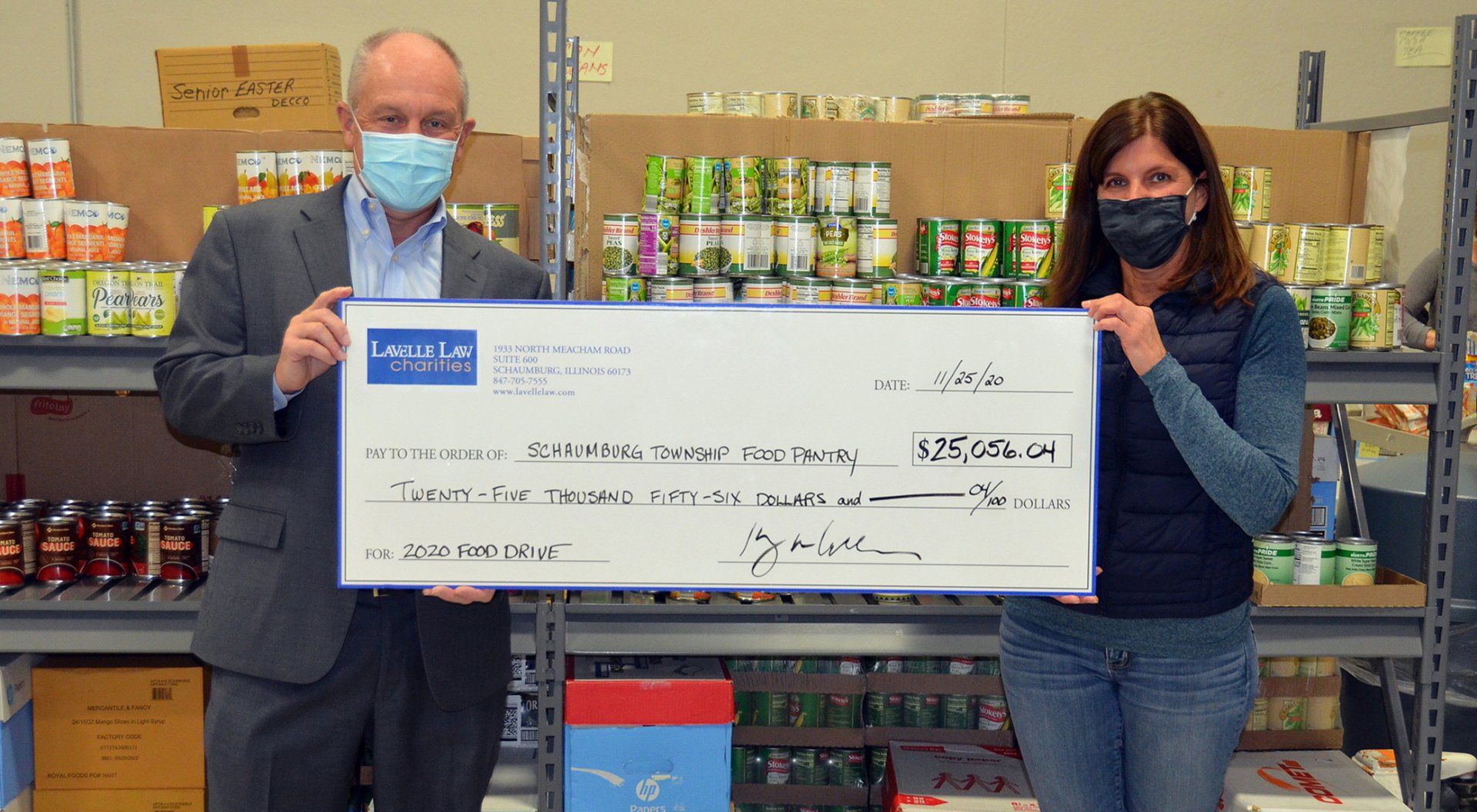

Lavelle Law Charities VIRTUAL Food Drive - 2020

COLLECTIVELY, OVER $25,000 RAISED!

As with so many other efforts in 2020, our annual food drive was virtual this year due to the pandemic and to avoid any unnecessary risks. In coordination with the Schaumburg Township Food Pantry and the Greater Chicago Food Depository, an online version of our food drive was developed. Donors either shopped online or contributed funds through a new, secure food drive portal. 100% of all food and cash donations went directly to the Schaumburg Township Food Pantry.

THANK YOU TO OUR 2020 DONORS!

The success of our annual Food Drive is dependent on the gracious support and contributions of the community and the wonderful businesses that partner with us to support this important cause. This year, Lavelle Law Charities matched the first $10,000 raised, bringing the grand total to over $25,000! We thank everyone who donated to the Lavelle Law Charities 2020 Virtual Food Drive. Your generosity and support of this very important cause go a long way in addressing the tremendous need in our community!

We would also like to recognize those who donated $250 or more to the cause, including:

Clearwater Capital Foundation – the philanthropic arm of Clearwater Capital Partners

Thunder Cares - the charitable arm of Norman Mechanical, Inc.

THANK YOU!

Lavelle Law Charities, NFP is a not-for-profit IRC Section 501(c)(3) charitable organization that serves many in the Chicagoland area. Historically, 99% of what we raise directly supports our charitable causes.

More News & Resources

Lavelle Law News and Events